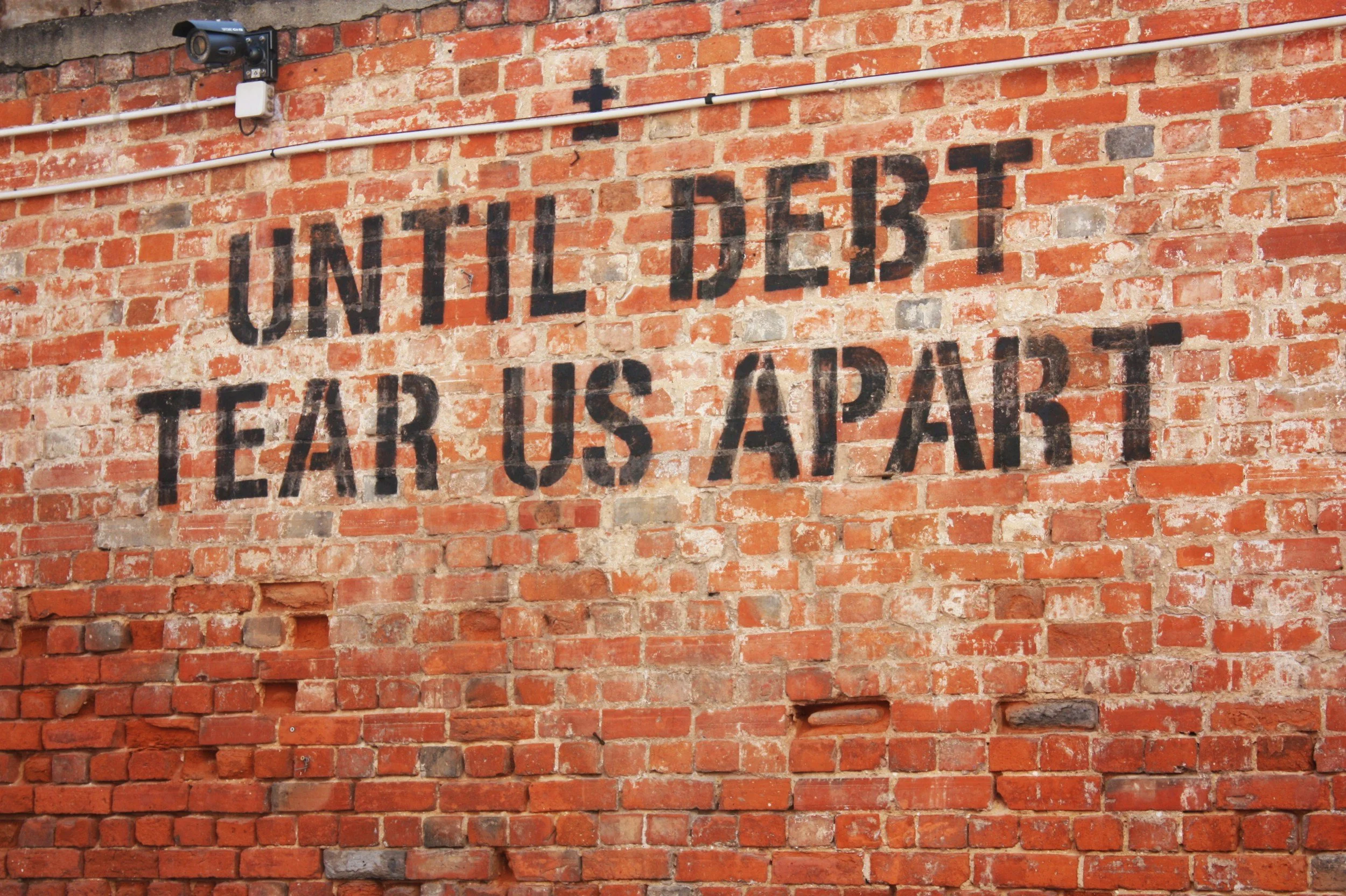

Americans today are carrying very high levels of credit card debt, and that makes protecting your credit more important than ever. Understanding how your balances compare and what steps actually move your score in the right direction can keep debt from quietly undermining your financial future.

Where Your Debt Stands

Total U.S. credit card balances are now around the 1.2 trillion dollar range, one of the highest levels on record. On an individual level, the typical cardholder carries a balance of roughly five to seven thousand dollars, though the exact number varies by age group and lender.

Generationally, Gen X tends to have the highest average credit card balances, with Millennials and Gen Z not far behind as living costs and interest rates remain elevated. Nearly half of American adults with credit cards report carrying a balance from month to month instead of paying in full, which means they are constantly paying interest rather than just paying for their purchases.

Why Rising Balances Hurt Your Credit

Credit card debt affects your credit score mainly through utilization, which is the share of your available credit that you are using at any given time. When that percentage climbs—especially above about 30 percent on any single card or across all cards—scores tend to drop, even if you never miss a payment.

High balances also make it easier to slip into delinquency if income drops or an unexpected bill hits. Recent data show late payments and delinquency rates on cards have been climbing, particularly among borrowers with lower credit scores, which can quickly damage credit and trigger penalty interest rates.

Practical Ways To Protect Your Credit

To protect your credit while dealing with card debt, focus on a few core habits:

Keep total utilization as low as you reasonably can, aiming to stay under roughly 30 percent of your total limits and ideally lower.

Always pay at least the statement minimum on time, every time, since payment history is one of the most powerful factors in your score.

If you are already carrying balances, try to pay more than the minimum and prioritize the cards with the highest interest rates so the debt stops growing as quickly. Where possible, consider tools like 0 percent promotional balance transfers or low‑rate personal loans—but only if you can pay them off within the promotional period and avoid running up new card debt at the same time.

Monitoring And Guarding Your Credit Profile

Good credit protection also means watching your reports and activity:

Check your credit reports regularly to confirm that all accounts and balances are accurate and there are no fraudulent charges or accounts you do not recognize.

Turn on alerts from your card issuers or banking apps so you get notified quickly about large transactions, international charges, or new‑account inquiries tied to your identity.

If you know you will not be applying for new credit soon and are especially worried about identity theft, a security freeze or fraud alert with the major bureaus can add another layer of protection. Coupled with strong passwords and two‑factor authentication on your financial accounts, this reduces the risk that your credit is damaged by someone else’s actions rather than your own.

Building A Cushion So You Rely Less On Cards

Finally, the best long‑term protection for your credit is needing credit cards less in the first place. Building even a small emergency fund—starting with one month of essential expenses and growing from there—can keep car repairs, medical bills, or short job gaps from going straight onto a card. As balances gradually fall and your on‑time payment history grows, your credit profile typically strengthens, which can qualify you for lower rates and better terms on future borrowin